When was the last time you reevaluated your personal financial goals? Did you set initial goals when you were in your 20’s and haven’t looked back since?

So many new clients I meet are operating from outdated financial road maps. Even though their lives may have changed drastically over the years, their financial goals have remained static, stuck in time and in major need of an overhaul.

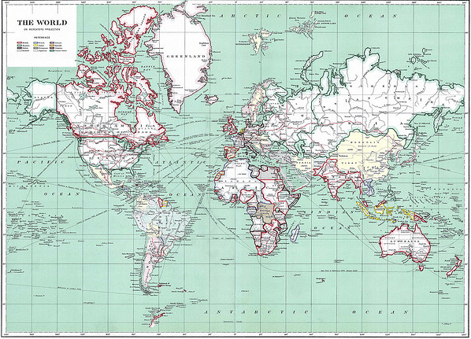

Just like maps become outdated, so do financial goals. Many times, what our financial goals look like when we’re young bears no resemblance to what we desire as we live life, get knocked around a bit and gain further awareness of our wants and needs.

Whose road map is it anyway?

Often times, we set financial goals without much insight into what’s driving the goals we’re establishing for ourselves. Often times, it’s the ‘back story’ that usually informs these decisions.

For example, say you grew up in a family where making money, a lot of money, was prized and reinforced into your psyche. Quantity vs. quality of life approach to your money or your life.

Perhaps your Dad or Mom or both were very ambitious and self-motivated. Growing up, you watched them achieve financial success. Let’s say they were very driven in their careers and sacrificed much to reach a certain level of financial status and power.

You graduate from college, spend the first 10 years or so figuring out what you want to do with your life and by your early 30’s, you’ve landed. Your career looks very promising and you’re happy. Now it comes time to start saving money and setting financial goals.

It’s at this point in your life where your relationship with money or lack thereof truly matters. Maybe you will follow the path your parent’s role modeled for you, maybe not. Regardless of the path you choose and the financial goals you establish, what’s most important is that your goals represent you and your vision.

Being conscious of your choices around earning, spending, saving and investing requires you to be mindful of your past money history and the assumptions and financial baggage you may still be carrying around unconsciously that heavily influence and impact your life today.

Many new clients I meet have been operating on auto-pilot in terms of their financial goals for most of their lives. The default position for many of us is to follow exactly what and how our parents dealt with their finances. For some this works fine. For most though, not so much.

Striving But Never Arriving

Another crucial aspect of reevaluating and or updating your financial road map is to make sure your goals are realistic given where you are right now, financially speaking. Very often, new clients I meet have set very unrealistic goals for themselves. Often times this leads to taking unnecessary and sometimes reckless investment choices.

Are your financial goals attainable? Do you have a viable chance of reaching the goals you set? Or do you constantly beat yourself up for not reaching your goals, only to take ever more risk with your money and striving yet never quite arriving.

Or are you someone that keeps moving the ‘goal posts’ on the road to financial independence farther and farther out of reach, with the result that you sabotage your chances of achieving financial success and most importantly, peace of mind around your personal finances.

It’s never too soon or too late to reevaluate your financial road map, so as the Nike saying goes, just do it!