To index or not to index - that is the question many investors ask themselves when building a durable investment strategy.

If you’re a savvy Vanguard type of investor, undoubtedly you’re a huge fan of legendary Vanguard founder John Bogle, who pioneered the concept and use of index funds decades ago. Since then, the indexing revolution has taken Wall Street by storm and is now a very common and core strategy deployed by retail as well as institutional investors worldwide. Yet even today, the active vs. passive management debate continues unabated.

For those of us making the strong case for index investing (passive), we rely on what’s known as the ‘efficient market hypothesis’, which essentially says that all known information about investment securities, such as stocks, is already factored into the prices of those securities. Therefore, no amount of analysis can give an investor an edge over other investors. This is one of the primary reasons why investors choose to invest in index funds. It is the “if you can’t beat them join them philosophy”.

But what if some information is not as widely known for some areas of the market as in other areas? Wouldn’t this mean that some areas of the market are less ‘efficient’ than others? If so, wouldn’t it make sense to use an index fund for the efficient areas and actively managed funds for the less efficient?

You don’t need to be a stock analyst or mutual fund manager to know that information about some publicly traded companies is more readily available, and therefore more widely known, than others. A majority of large-cap stock mutual fund managers fail to beat the best S&P 500 Index funds over long periods of time because there is much more information available on the larger companies than the smaller ones.

Therefore, it takes more effort in the form of research and relative market risk to outperform the broad market indexes. This also increases expenses, which makes it even more difficult to compete with the low-cost index funds.

Choosing Between Index Funds or Active Funds

When asked recently in a Money Management Executive article about using Vanguard’s index or active funds when constructing a long-term portfolio, John Bogle said the following: “If you want to feel good; I tell people to put 95% in a serious money account (big index funds in one form or another) and 5% in your “funny money” account.

My preference when building and managing a client’s investment portfolio is to combine the wisdom of indexing with the advantages of actively managed funds for less efficient markets. For example, a good strategic model for a long term investor would be to have index funds form the core of the strategy at around 60-80% allocation and a combination of small-cap, international, some international bond funds and some sector funds to round out the portfolio.

Each quarter, I monitor the performance of all Vanguard funds we regularly use. Some years the variance between say a small cap index fund vs. an actively managed small cap fund is so minor as to not be worth noting. Other years, the difference is striking.

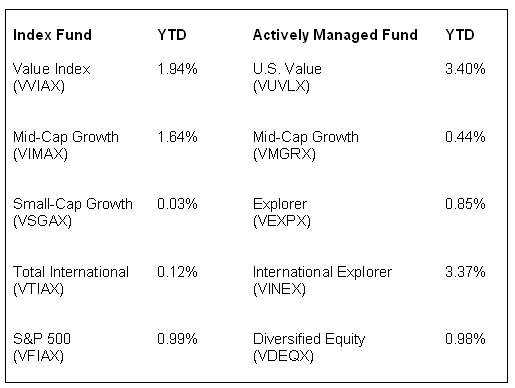

Below are some results to share with you based on Vanguard funds performance as of Friday, March 28th, 2014, comparing an index fund’s performance to an actively managed fund’s performance for the same asset class.

Vanguard Fund Performance as of 3-28-2014

Notice how small the variance is between the S&P index fund vs. the comparative large-cap fund at Vanguard. Also, keep in mind, actively managed funds have higher expenses than index funds. For example, the Value Index fund listed above has an annual expense ratio of 0.10% for Admiral shares vs. a 0.30% expense for the U.S. Value actively managed fund. Although that seems like a small difference, over 10, 20 or 30 years, that small difference really adds up down the road.

Bottom line: If you’re drawn to the many advantages of utilizing index funds for your long-term investment strategy, you’re in good company. Now the question remains, do you go all in and use 100% indexing, or 95% as Bogle recommends OR a combination of the two?

I would argue that in this fast changing world we find ourselves living in, with high frequency traders (HFT’s) looking to gain trading advantages in milliseconds (see article on ‘Flash Boys: A Wall Street Revolt’ by Michael Lewis- that the answer not be simply either/or.

Disclaimer: The information in this blog is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. All investing is subject to risk, including possible loss of principal.

Photo credit http://www.flickr.com/photos/uncut/