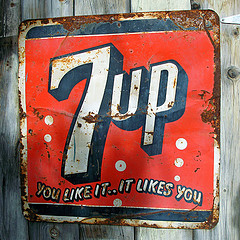

Who remembers the 7-up ‘un-cola’ commercials? All these decades later I still remember that distinctive voice of actor Geoffrey Holder. If you want a flashback-here he is in a YouTube video that will bring you back in time: 7-up

Just like 7-up was, and is the alternative to cola, semi retirement, the new way to retire early, is the alternative to retirement as we have come to know it. In fact, the best kept secret in the financial planning industry is the research being conducted right now on the generation that retired during the second half of the 20th century. The question being seriously asked and studied is this: Was that generation’s retirement success an anomaly? In other words, is this the end of retirement as we know it for future retirees?

The answer to that and many more questions will be revealed during the next few years. Yet to most financial planners like myself that specialize in retirement planning, the answer seems pretty obvious. Yes, retirement as we know it is changing and it’s time to adapt and reevaluate your assumptions and plans.

Out With the Old, In With the New

Retirement for most people has almost exclusively been a number to reach. Whether its $1million or $10 million you need to have accumulated by the time you reach the finish line, the focus has and still remains on the number. When asked to describe the type of lifestyle they envision when retired, most people draw a blank.

It’s not their fault that they’re unable to tap into their imagination because the old paradigm of retirement was all about the number. But the new paradigm will be all about lifestyle choices and this is where semi-retirement will play a leading role.

The Road Less Traveled

Let’s say you’re in your mid 50’s and you went to a fee-only financial planner for help in assessing your future retirement options. During the discovery phase of your meeting, you make it clear that you don’t really like your job, it stresses you out big time and that your boss is a bit of a tyrant but like everyone else you know, you’ll deal with it as best you can because the number is the holy grail of retirement planning and besides, what other options are there?

The other option of course is looking at your live-work situation in a whole new way. This new way forward is called semi retirement planning and it’s quickly becoming a trend among baby boomers looking for an alternative strategy to the current retirement options being offered.

The details, the strategies and the tactics needed to design your semi-retirement plan await you. And if you’re thinking that this sounds more like a fantasy than a reality, especially in this type of economy, please think again. The time has come for un-retirement thinking to take center stage.

If you need some courage and inspiration to take the next step on this journey, check out the superb book on the subject of semi-retirement: Work Less, Live More written by Bob Clyatt. This is an essential guide for anyone contemplating this financial life decision. Inside the book you’ll find specific details on how to make this happen as well as true stories from people that are semi-retired.

It’s your life and you can design it anyway you want. What are you waiting for?

Photo by kevindooley